2 Perseverance

Despite COVID-19-related restrictions, we continued with roll-out plans for increased ESG integration and focus on responsible investment practices throughout our operation. Our commitment to the SDGs remained solidly in place and we ramped up our responsible investment efforts both at a social level as part of our CSR activities and in terms of our active investments.

Laying Solid Foundations: ESG Integration Across Key Functions

Since articulating its Social Purpose in 2014, EFG Hermes has taken measured and consistent steps to integrate ESG factors in every aspect of its operation and create an ecosystem that supports the fulfilment of the SDGs. This process has involved several activities which have helped us develop a deeper understanding of the value of ESG, both to our business and to society. As members of the United Nations Global Compact and signatories of the UN Principles for Responsible Investment (PRI), we assessed our activities and practices and identified barriers to ESG integration across business lines and support functions.

In 2020, we incorporated ESG factors into our business manuals and processes, laying out our Responsible Investment Policy, providing a general ESG framework, and outlining the approach to ESG integration across our four business lines: private equity, investment banking, asset management and research, as well as recommendations for various support functions. These guidelines will equip our investment professionals with the knowledge, procedures, and tools, needed to take active ownership of ESG integration and move forward to the next step of actively seeking out impact investments in various fields.

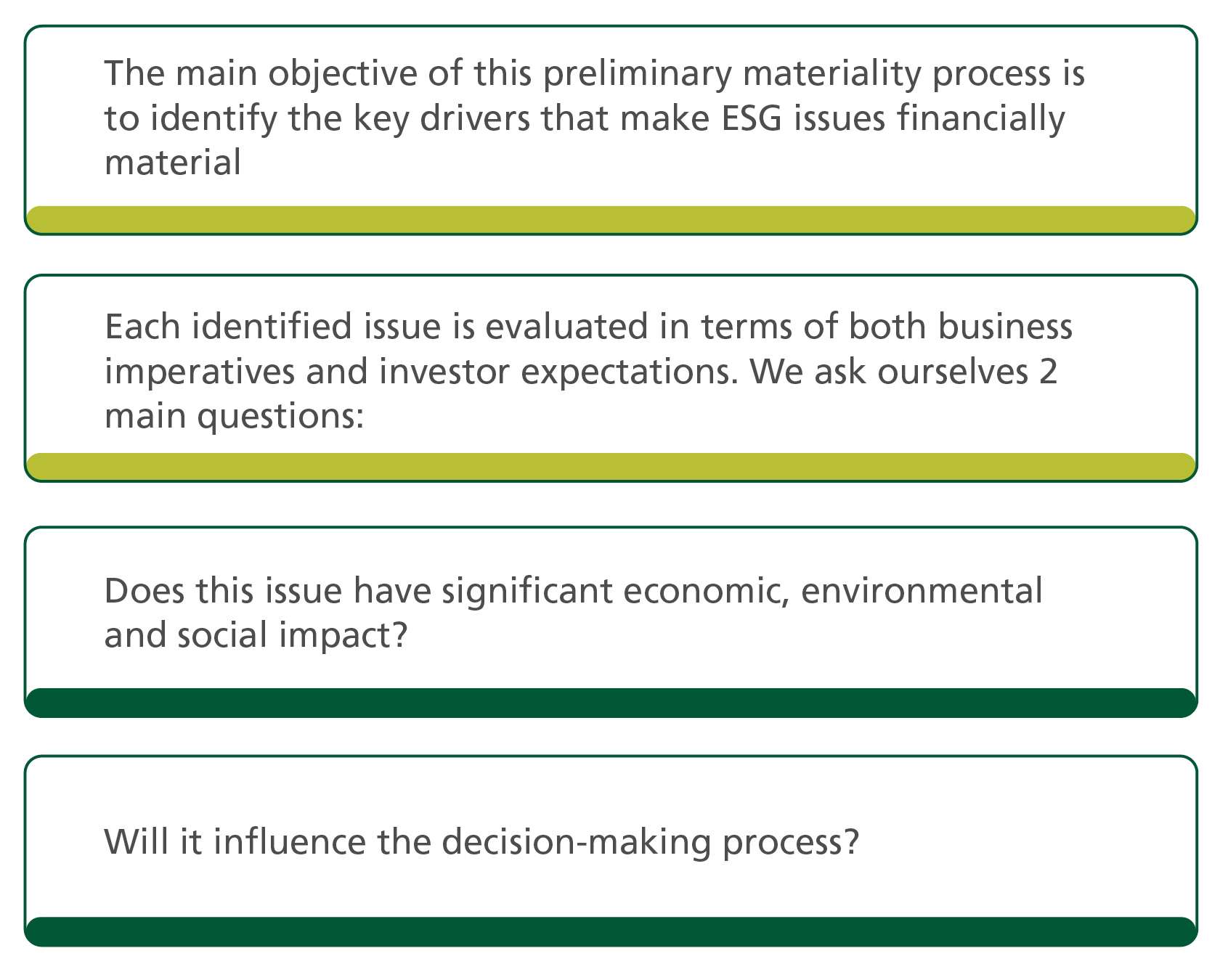

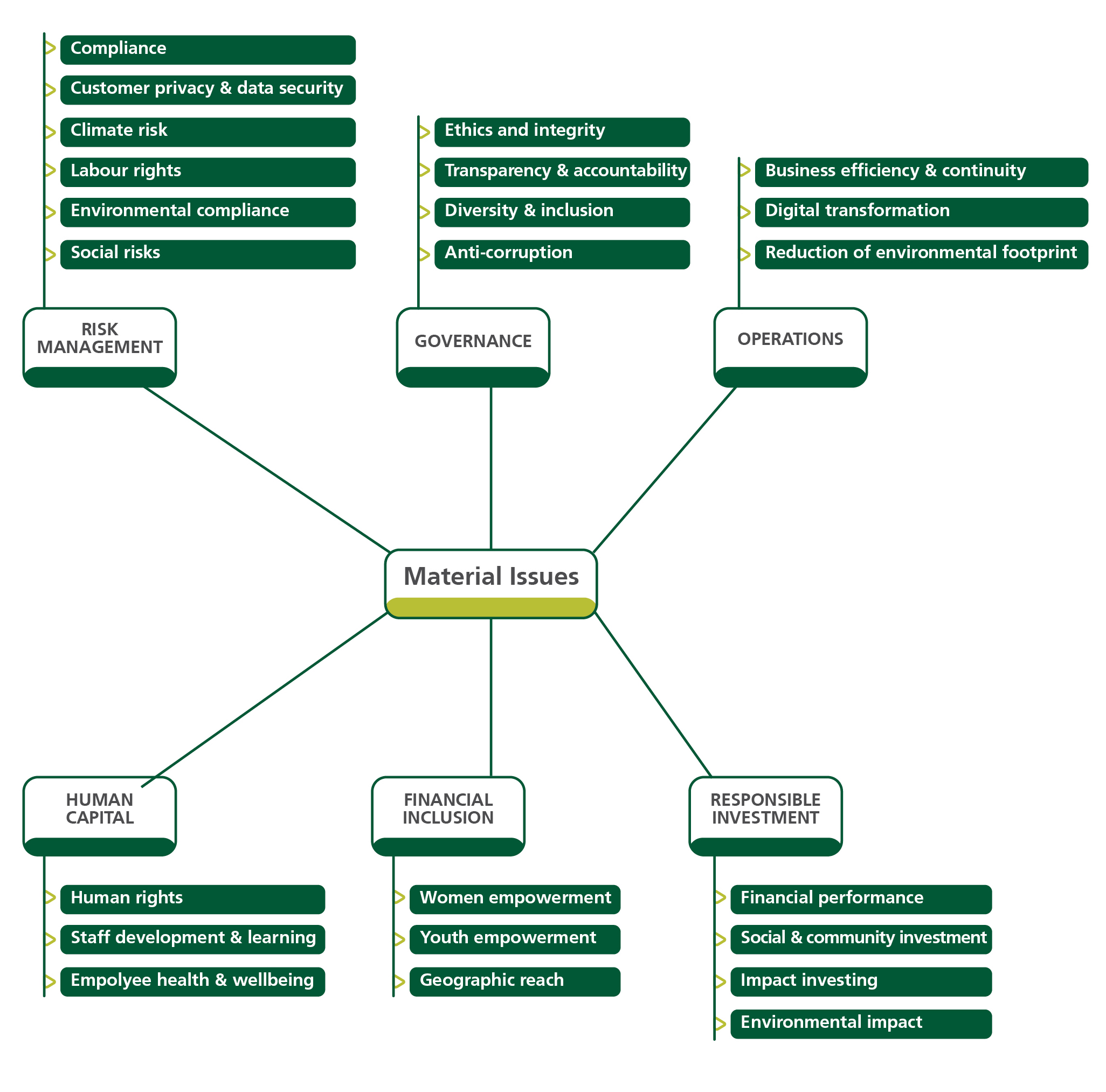

Identifying the Issues: Materiality Mapping

As part of our ESG integration process, each of our business lines is tasked with identifying the key material ESG factors and ensuring that they are considered in a pragmatic and sector-specific manner. Our materiality mapping process evaluates key criteria and their relative impact on financial results and key performance indicators (KPIs) and helps develop the ESG framework and tools to enable each business line to effectively engage with issues and stakeholders and monitor progress1.

*1 This chart is for illustrative purposes only. Actual analysis is subject to confidentiality considerations.

EFG Hermes: Sustainability Champion

The Egyptian Financial Regulatory Authority (FRA) has been playing a proactive role in promoting sustainability practices within the non-banking financial sector through the proactive engagement of companies to introduce new concepts and practices and through the drafting and development of relevant regulations. In early 2021, they issued their first report on sustainability champions in the Egyptian non-banking financial sector. The publication is designed to highlight best sustainable practices adopted by the companies operating in the sector and share their success stories with other stakeholders and companies. The strategic objective is to encourage other companies supervised by the FRA to follow suit and start taking serious steps towards institutionalizing sustainability within an appropriate governance framework.

EFG Hermes was among 4 Egyptian entities identified as Sustainability Champions in this inaugural FRA sustainability publication. The EFG Hermes case study demonstrates how to implement a strong sustainability agenda and play a key role in advocating for sustainability issues within the sector.

Realizing the SDGs: Naga’ El Fawal & El Deir Village Integrated Development Project

The COVID-19 pandemic has highlighted how global challenges cannot be addressed in isolation. This holds particularly true for the complex development challenges presented by the 2030 Agenda and the SDGs, which encompass almost every aspect of life. An integrated, holistic approach remains the only way to achieve meaningful progress towards fulfilment of the SDGs.

The EGP 70 million Naga’ El Fawal and El Deir Village Integrated Rural Development Project takes just such a holistic approach to the SDGs, tackling almost all the targets applicable to rural environments simultaneously. Benefitting over 75,000 inhabitants, the project involves the rehabilitation of an entire community starting with infrastructure development and encompassing economic and human development initiatives and access to services

The project demonstrates how partnerships between the private sector, the government, and civil society can result in innovative, sustainable development initiatives. The private sector is by nature dynamic and capable of responding decisively to changing market or client needs. By applying private sector investment principles to the development process, the project has been able to effect a profound transformation in Naga’ El Fawal and El Deir Village. When rising energy costs threatened the project, the team redesigned the community centre to be completely powered by clean energy. This not only an environmental leap into the future for the rural community but an economic one as well: excess power from the solar energy unit is sold into the grid to generate much-needed income.

The key lesson we have learnt is that partnership is vital in order to localise and implement the SDGs. The problems that face us today are multi-faceted, and sustainability hinges on buy-in from all stakeholders. The SDGs provide a common language and a unified sense of purpose across all dimensions of sustainable development, whether at the level of government, civil society, or business. We believe that it falls to organizations such as ours to take the lead and bring stakeholders together to develop strategies that work within local contexts.

Towards 2030: Naga’ El Fawal and El Deir Village Integrated Rural Development Project

A Vision for the Future: Impact Investing at EFG Hermes

EFG Hermes boasts a global impact investment portfolio that directly feeds into the SDGs in areas ranging from clean energy to healthcare and education. From a business perspective, many shareholders, funds, and investors today prioritise impact investment as the way forward to a more inclusive future. We not only attempt to enhance the financial return of our investments but also seek to ensure positive environmental and social dimensions to the projects in our portfolio.

In November 2020, EFG Hermes was selected as one of 30 regional companies included in the new Low Carbon Select Index brought to market by the Arab Federation of Exchanges (AFE) and market data provider Refinitiv. Refinitiv AFE Low Carbon Select Index offers an innovative benchmark for investors wishing to commit capital to companies that actively invest in and promote low carbon activities in the running of their businesses. The index includes those companies as constituents that are investing to reduce energy consumption and hence contributing to lower the carbon footprint of the region. The constituent universe includes equities traded in Bahrain, Egypt, Jordan, Kuwait, Morocco, Oman, Saudi Arabia, Qatar, and the United Arab Emirates.

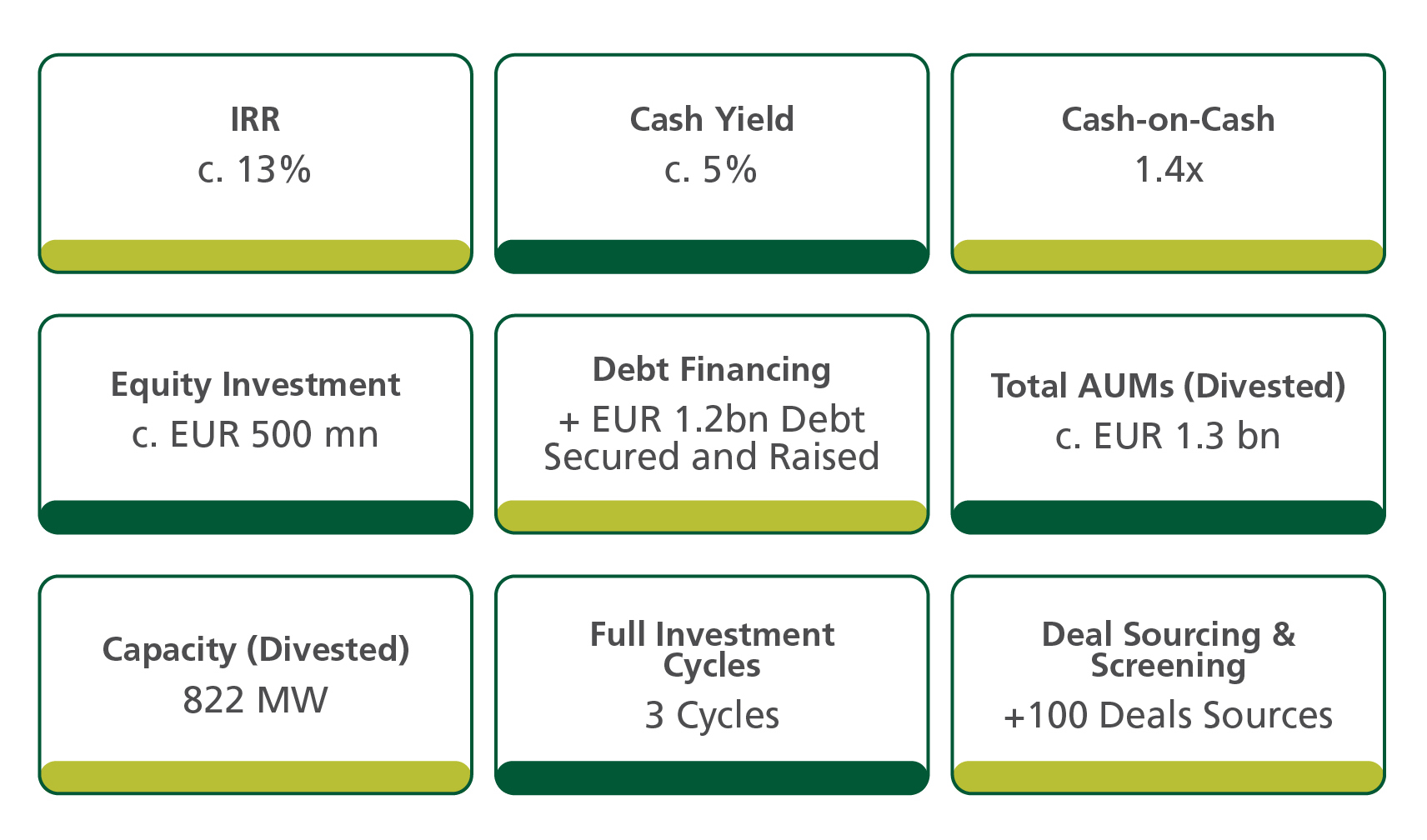

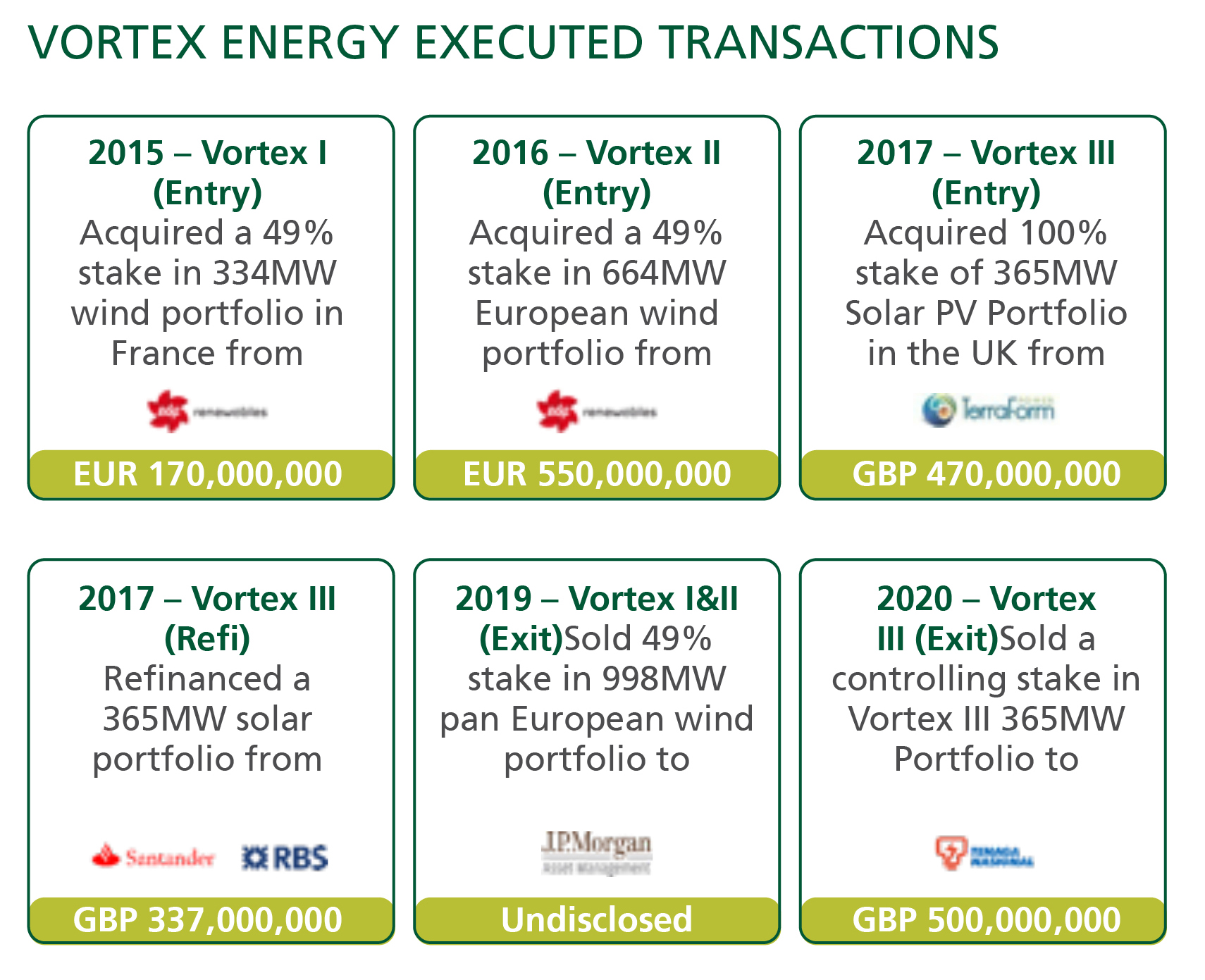

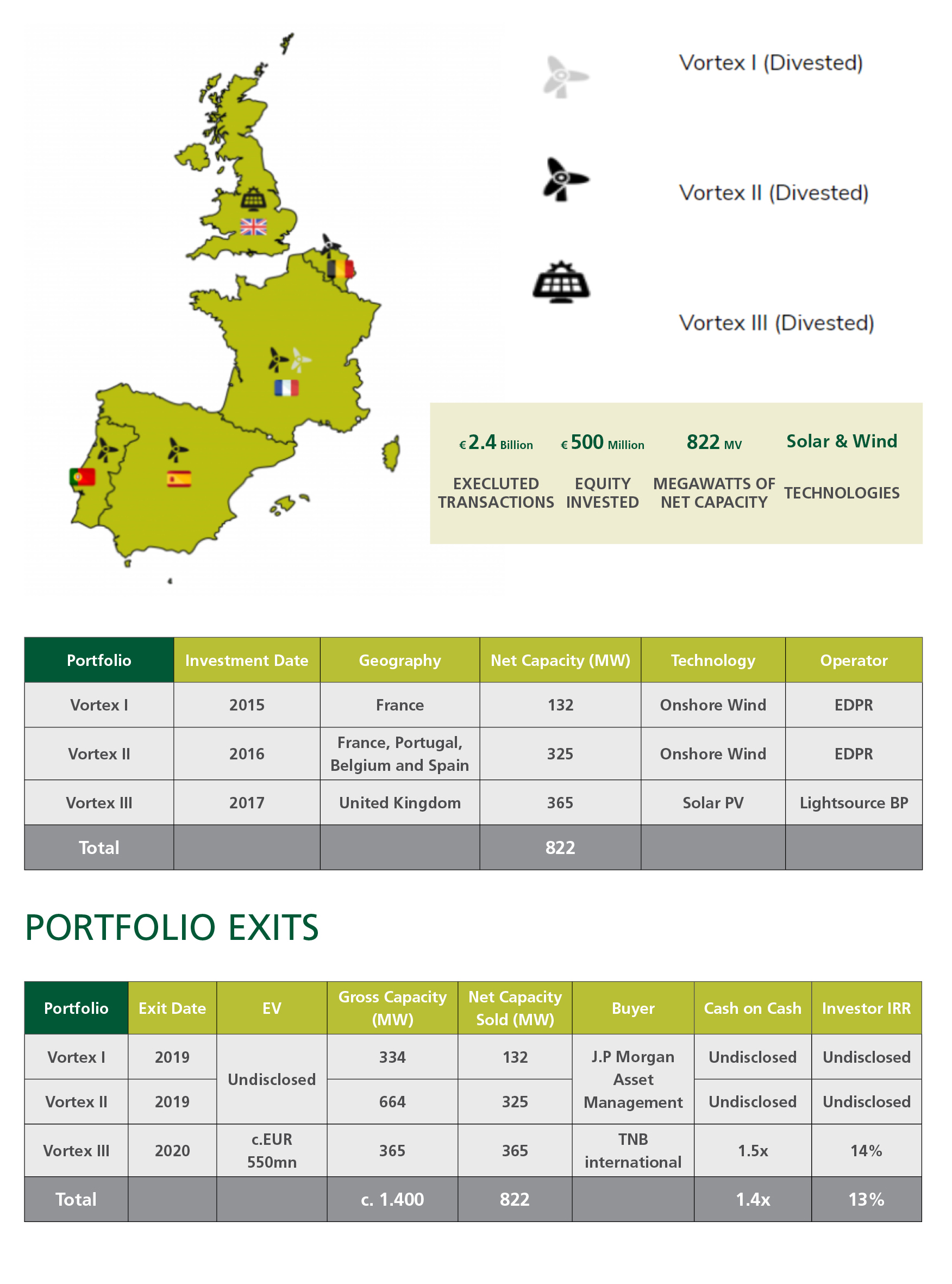

Clean Energy: Visualizing Vortex Energy

Vortex Energy is EFG Hermes’ flagship global renewable energy platform. Established in 2014 with a mandate to invest into the renewable energy sector on behalf of long-term institutional investors. Vortex Energy has completed the entire investment life cycle from origination, investment, and asset management to refinancing and divestment while meeting its target risk adjusted returns for its investors. . Vortex has successfully achieved a C-o-C of 1.4x and blended returns of c.13% to its investors from 2015 to 2020.

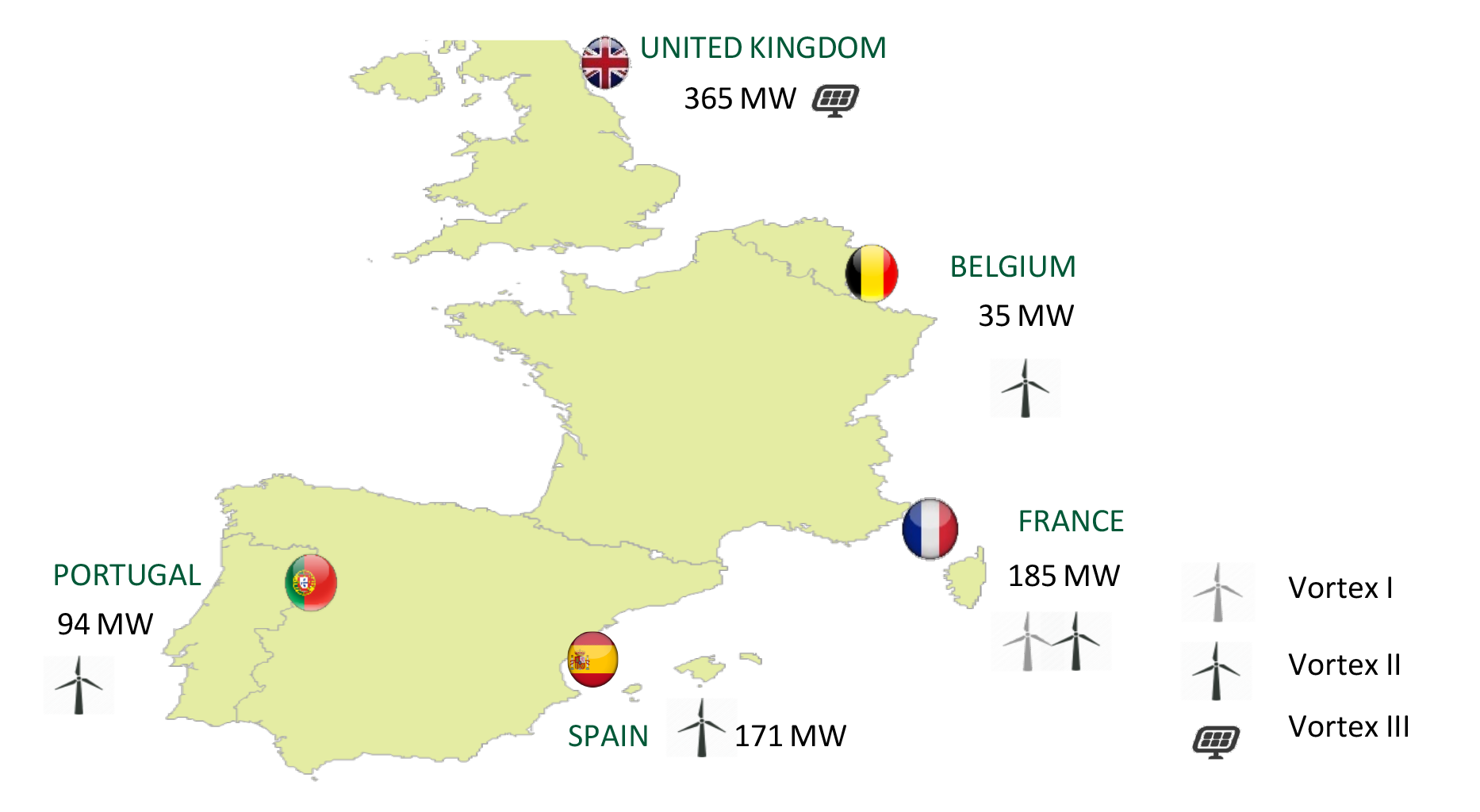

Vortex Energy Geographical Distribution

Most recently in 2020, Vortex Energy completed the sale of its controlling and managing stake in Vortex Solar (“Vortex III”), a 365MW solar PV portfolio, acquired in 2017 from TerraForm Power, at an enterprise value of c. GBP 500m. The stake was sold to TNB International Sdn Bhd, a wholly owned subsidiary of Tenaga Nasional Berhad (“TNB”), an existing shareholder in the business and one of South East Asia’s largest utilities with an installed capacity of c.15GWs globally. Vortex III is one of the largest standalone portfolios in the UK, with an average asset age of 6 years, PPAs with major European energy companies and utilities, an attractive ROC regime and a long-term debt package from major lenders including Santander, RBS and ING. The portfolio achieved an EBITDA of c. GBP 39mn in 2019 with an 84% EBITDA margin, exceeding its budget and providing attractive cash yields to its shareholders.

Vortex Energy’s New Clean Energy Platform: Vortex Energy IV

Vortex Energy is establishing Vortex Energy IV, which will provide investors with access to a portfolio of energy transition assets and investments, providing double-digit returns on investments in a sustainable and growing sector. Vortex Energy IV will target various portfolios and businesses, ranging from solar and wind generation assets to IPPs, Battery Storage and Distributed Generation, which are forecast to continue to grow and attract capital in the next decade. The project pipeline is targeting clean energy transition businesses that fall along a strategic investment spectrum from traditional businesses to growth and technology-led businesses. This blended approach will benefit investors by providing a combination of (i) growth driven by development, capacity increases and technological advancements and (ii) stability that is underpinned by contracted and visible stable cash flows.

Vortex Energy IV is set to contribute to reducing global carbon emissions and achieving net zero policies.

The Right to Learn: The Egypt Education Fund

In 2018, EFG Hermes Private Equity entered into an exclusive partnership with Global Education Management Systems (GEMS), one of the world’s leading providers of private English-language education for students from kindergarten to twelfth grade (K-12), to jointly establish a USD 200 million platform focused on Egypt’s underserved K-12 education sector. The partnership aims to provide high-quality education choices for Egyptian families by building Egypt’s largest institutional education service provider, upgrading education facilities and providing safe and effective learning environments. In 2019, the Fund acquired a majority stake in the leading transport provider, Option Travel to provide a high quality and competitive student transportation service to c. 6k students currently enrolled in GEMS schools in Egypt.

EFG Hermes has always placed great value on education and particularly on financial literacy and workplace readiness for students. Over the years, the Group has produced a series of financial literacy videos, sponsored the Model Egyptian Stock Exchange, and conducted orientation and mentorship sessions for students at several Egyptian universities. In 2020, EFG Hermes partnered with GEMS Egypt for Education Services to provide a series of learning opportunities for senior students, exposing them to the professional world and enabling them to learn by doing. The aim of the sessions was to increase students’ employability skills, help them make better career choices and provide mentorship opportunities. These sessions were provided in collaboration with valU.

Prioritizing Health: Rx Healthcare Management

Rx Healthcare Management (RxHM) is a private equity investment management firm set up to address the growing demand for high-quality, affordable healthcare products and services across Egypt, the MENA region and Africa. It invests in highly selective targets, with a clear growth trajectory across healthcare verticals, giving investors access to unique opportunities across the sector’s value chain. The Firm’s investment approach is predicated on providing growth capital through investing in controlling stakes (and on selective basis, in controlled minority stakes) in companies operating in the segments of pharmaceuticals manufacturing and other complimentary healthcare sub-segments.

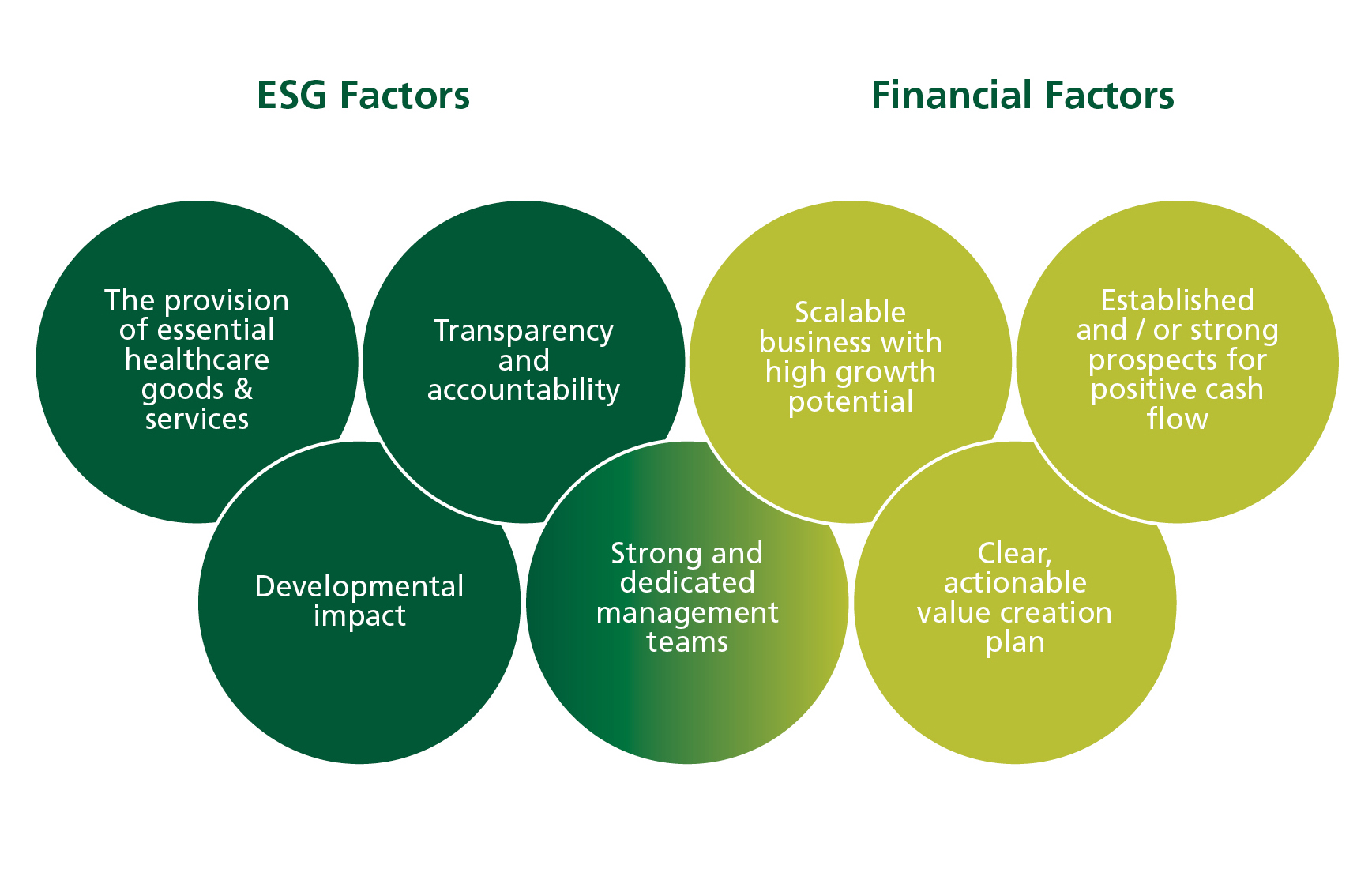

RxHM places a high value on ESG investment considerations. Target investments must combine both financial viability and fulfil ESG criteria to ensure sustainable value add that fills a tangible healthcare gap in this highly underserved region.

Rx Healthcare Management (RxHM) latest acquisition is a leading Egyptian medical solutions provider U Pharma through Nutritius Investment Holdings, a special purpose vehicle set up for the acquisition. The transaction attracted significant interest from prominent investors, with proceeds being used to expand the company’s product offering to cover essential categories in underserved therapeutic areas and ramp up production for existing products. U Pharma is Egypt’s leading player in the injectables space by installed capacity and has an established track record of exports to key African and Middle East markets.

The transaction reflects the resilience of the Egyptian pharmaceutical market, which has consistently enjoyed double-digit growth over the past 10+ years as the biggest MENA healthcare sector.

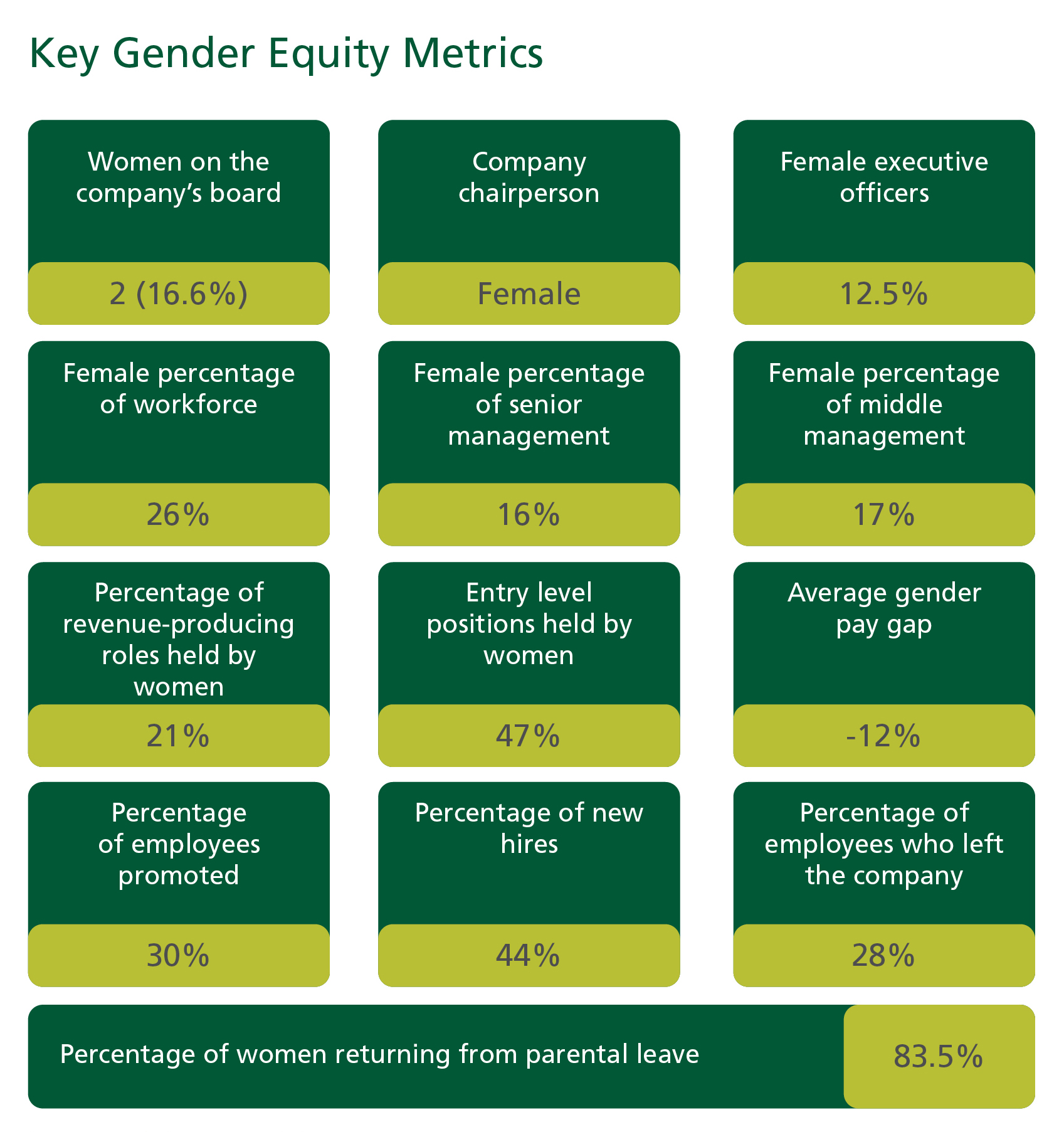

Closing the Gap: Gender Equity at EFG Hermes

In March 2020, EFG Hermes produced a series of videos celebrating Mother’s Day and highlighting the challenges and rewards of being a working mother in a field as highly competitive and demanding as financial services. These videos were part of EFG Hermes’ internal awareness strategy on different SDGs and served to draw attention to gender-related issues within the Group. Female employees in different fields and offices spoke about the difficulties of time management and the unavoidable guilt that accompanies having any career for women. They also spoke about the importance of being in a supportive work environment that encourages women to achieve their full potential and provides equal opportunities for career advancement.

At EFG Hermes, we pride ourselves on providing clear career paths and a supportive, equitable environment for women at all levels throughout the Group. From training opportunities to mentorship and inclusive policies, we create a welcoming working environment where women can grow and thrive. We also specifically seek to empower female entrepreneurs running home-based businesses through Tanmeyah, our microenterprise arm, and its USD 5mn ‘Women in Business’ microloan facility.

In Good Company: Women & Leadership

For women entering the workforce today, it is vital to have strong role models who demonstrate that women can fulfil their career potential and reach the highest leadership positions. EFG Hermes prides itself on being one of very few listed companies in the Middle East with a female chairperson, Mona Zulficar, who has held the position since 2008. Across the Group, there are also many other examples of women in leadership positions working to advance gender parity and underlining the company’s commitment to attracting, retaining, and developing women into senior leadership positions.

Mona Zulficar, Chairperson, EFG Hermes

For the second year running, our Chairperson, Mona Zulficar, was selected as one of Forbes Magazine’s top 100 Power Businesswomen in the Middle East, ranking #17 on a prestigious list that spans formidable women in government, industry, and civil society across the Middle East. One of the main criteria for selection are the initiatives and causes championed by the nominees. In addition to being one of Egypt’s most prominent corporate, banking and project finance attorneys, she has played an instrumental role in modernizing and reforming economic and banking laws and regulations as a former member of the board of the Central Bank of Egypt and as a prominent member of national drafting committees. She is also a leading human rights activist recognised locally and internationally and has initiated several successful campaigns for new legislation

including women’s rights, freedom of opinion and family courts. She is currently member of the National Council for Human Rights. She has also recently been elected President of the Egyptian Microfinance Federation and has been chairing several NGOs active in social development and microfinance for poor women. She is an unremitting champion of ESG issues and the drive to achieve the SDGs both at EFG Hermes and elsewhere. Her support for the work conducted by the EFG Hermes Foundation on the EFG Hermes board has allowed the Foundation to thrive and maximized the social impact aspect of EFG Hermes activities.

Lilian Olubi, Chief Executive Officer, EFG Hermes Nigeria

Lilian Olubi is currently the CEO of EFG Hermes Nigeria and brings over twenty years of Capital Markets experience to her role. Committed to social development and responsibility, she has also founded Gold Lilies Global Services, a social venture conglomerate aimed at empowering personal and organizational growth in various sectors and also the Drug Aid Africa Initiative, which offers free medical drugs and supplies to patients in impoverished communities. An advocate of social entrepreneurship, she believes strongly that social enterprise and SMEs are vital to building a strong economy. Her philosophy is that women must be deliberate about their career choices if they are aiming for leadership positions instead of settling for ‘easier’ roles. Moreover, women who have achieved great heights in their fields should be willing to provide mentorship to younger women and help them overcome existing barriers and actively be a part of creating a new ideal for women in business and leadership.

Inji Abdoun, Group Head of Human Resources/CHRO, EFG Hermes

As group chief human resources officer at EFG Hermes, Inji Abdoun provides HR support to over 3,000 employees and managers in 10 countries spanning the Middle East as well as Kenya, Nigeria, Pakistan, the UK and the US. She sits on the firm’s Executive Committee as chief human resources officer. She joined the firm in 2007 as HR manager, taking an active role in the integration of the acquired Oman and Kuwait operations, and setting up the HR function in the KSA operation. She firmly believes that women should continuously work to upgrade their skills and capabilities in order to become more effective in their chosen career environment. When she was invited to sit on EFG Hermes’ Executive Committee – as the first HR representative and the first woman on the Committee – she knew it was time to get an MBA to ensure that she could actively contribute to all aspects of the decision-making process. In her capacity as Group Head of HR, she extends this philosophy to the talent development programs offered to employees, making sure that each staff member has the opportunity to bolster needed skills or acquire new ones that help with career advancement and growth.